Your Personal AI Financial Advisor

(Without the $300/hr Price Tag)

- A simple shortlist of what's most worth your attention

- Insights personalized just for you

- Delivered at the moments they matter most

Start Your Free Trial

🛡️

30-Day Money Back Guarantee

Beat the Market or Cancel and Pay Nothing

Our AI Never Sleeps

Updates 24/7/365, 100s of ratings per day

3X

Oct Returns vs SPY

3X

Nov Returns vs SPY

2X

Dec Returns vs SPY

What You Get

All for a limited time price of $69 $9/mo

Want to go deeper?

- Company Report Summaries (earnings & financial highlights in plain English)

- Deeper AI scoring explanations

- Period-over-period performance indicators

- Sentiment analysis from news and social sources

- Full drill-down pages for each stock

🎯 You don’t need this level of detail — but it’s there when you want it.

Professional Level Insights

Powerful tools under the hood — available whenever you’re curious

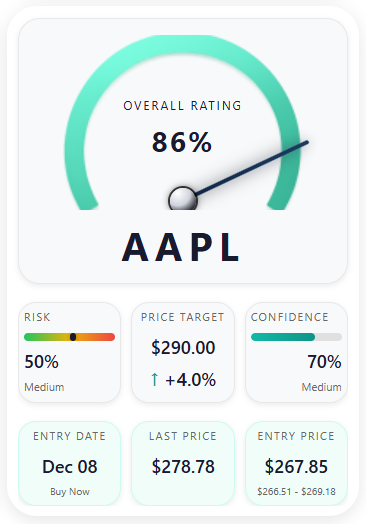

Clear Stock Ratings

Strong Buy / Buy / Hold / Sell - know exactly where each stock stands at a glance

Risk Level

Low / Medium / High risk indicators help you match picks to your comfort zone

Confidence Score

See how confident our AI is in each recommendation before you invest

Entry Date & Price Range

Know the optimal entry points so you never chase a stock too late

Market Mood & Sector Sentiment

Understand the bigger picture with real-time market and sector analysis

Daily Summaries + Alerts

Get actionable insights delivered to your inbox when they matter most

What You Get With MarketMoodz

No Guessing

Nobody wins all the time, but you can maximize your chances with clear signals

No Biased News

We filter out the noise and focus on the facts, no paid articles or fake news here

Complete Information

Compare apples to apples to choose the best investments for you with all of the information you need at your fingertips

Why Smart Money Trusts MarketMoodz

Data-Driven Ratings

Our AI analyzes millions of data points to identify opportunities before the crowd

Proven Track Record

The Audit page is linked in the menu to give you full transparency

Premium Insights

Access the same ratings system that consistently generates returns

Stop Watching Others Win

Join MarketMoodz today and start beating the market tomorrow

Normal: $69/month

$9/month

Cancel anytime - no questions asked

CLAIM YOUR 7 DAY FREE TRIAL NOW

🛡️

30-Day Money Back Guarantee

Beat the Market or Cancel and Pay Nothing